NEWS A Guide to Insurance Fraud Investigation in Japan

Insurance fraud is a big problem. It costs companies a lot of money every year. When you think a customer is committing fraud, it’s very important to investigate. If you don’t, the money you lose to fraud will only grow. A proper investigation is the only way to get the proof you need to deny a fake claim and protect your business. But these checks are complex and need a lot of skill. This guide explains how a professional detective agency checks for insurance fraud in Japan. At FAM Investigation Agency, we are a trusted agency with the experience to handle these serious business cases.

Table of Contents

- How Insurance Fraud Hurts Your Business

- Types of Fraud We Investigate

- How We Investigate Insurance Fraud

- Why You Need a Professional Investigator

- Why Choose FAM for Corporate Investigations?

- Conclusion: Protect Your Business from Fraud

How Insurance Fraud Hurts Your Business

Insurance fraud is not a victimless crime. It hurts your company’s financial health.

- You Lose Money: Every fake claim you pay is a direct loss for your company. Over time, these losses add up.

- Costs Go Up for Everyone: To cover fraud losses, insurance companies might have to raise prices for all of their honest customers.

- You Waste Time and Resources: Your team spends a lot of time on fake claims. This takes them away from helping real customers with real problems.

By checking suspicious claims, you protect your own company and help keep the insurance system fair for everyone.

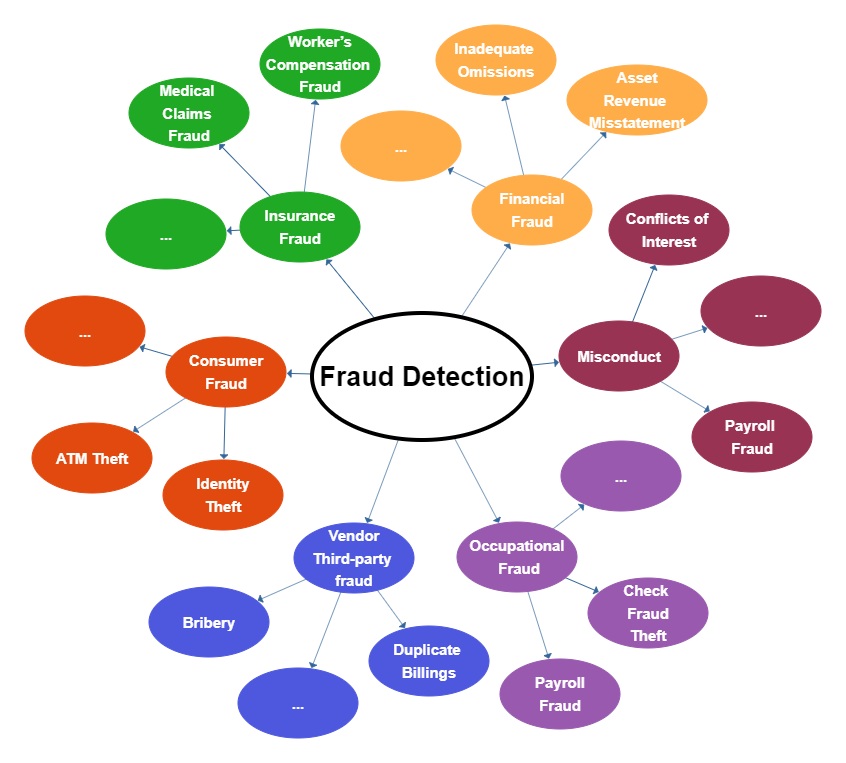

Types of Fraud We Investigate

Fraud can happen with any kind of insurance. Our investigators have experience with the most common types in Japan.

- Car Insurance Fraud: This is very common. It can be a staged accident, a fake hit-and-run, or someone lying about how much their car was damaged.

- Injury and Medical Fraud: This is when someone fakes an injury to get disability money. For example, a person says their back is too hurt to work, but they are really living a normal, active life.

- Robbery Insurance Fraud: This is when someone falsely claims they were robbed to collect insurance money. They might lie about a home break-in or a street mugging to get paid for items that were never stolen.

- Life Insurance Fraud: This is very serious. It can involve faking a death to get the insurance payout.

- Property Damage Fraud: This is when someone damages their own property on purpose, like setting a fire, to collect the insurance money.

Each type of fraud needs to be investigated in a different way. This work is a special part of our due diligence and corporate investigation services.

How We Investigate Insurance Fraud

Our goal is to get you clear, factual proof that you can use in court. We use a mix of research and in-person fieldwork.

- Claimant Background Check: We start with a deep background check on the person making the claim. We look for red flags, like if they have made many claims before or have money problems.

- Discreet Surveillance: This is our best tool for injury claims. Our team can secretly follow and film the person. If they say they are too hurt to walk but we film them playing sports, you have strong proof to deny the claim.

- Accident Scene Review: For car accidents, we can visit the scene and take a look. We can often tell if the story about the crash makes sense or if it seems fake.

- Talking to Witnesses: We can quietly find and talk to any witnesses to see if their story is the same as the claimant’s.

Why You Need a Professional Investigator

Checking for insurance fraud is a job for experts, not your own staff.

- It Takes Special Skills: Secret surveillance is a skill that takes years to learn. Our agents know how to watch someone without being seen.

- You Need Legal Proof: The evidence must be collected in a legal way so it can be used in court. Our licensed investigators know the rules.

- It Saves You Time: Your team is busy. Our team’s only job is the investigation, so we can get it done faster.

– You Get an Unbiased Report: As a third party, we give you a report that is based only on facts. This is more credible than a report from your own team.

Why Choose FAM for Corporate Investigations?

When your company’s money is on the line, you need an agency that is professional and gets results.

- We Are Experts in Business Cases: We have a lot of experience working with insurance companies on fraud cases.

- Our Evidence is Clear and Useful: We give you detailed reports with photos and videos that you can use to make a decision.

- We Are a Licensed and Trusted Agency: FAM Investigation Agency is fully licensed by the Japanese Public Safety Commissions. Our work is always legal.

- Our Work is a Secret: Everything we do is 100% confidential. This protects your company and the investigation.

The cost of a check can change depending on the case. To learn more, you can read our guide to investigator costs.

Conclusion: Protect Your Business from Fraud

Don’t let fake claims drain your company’s money. When you see a suspicious claim, a professional investigation is the smartest move. It is a direct investment in protecting your business. The proof from an investigation gives you the power to say “no” to fake claims, save money, and show that you will not tolerate fraud.

If you think a customer is committing insurance fraud, contact FAM Investigation Agency today for a free and private talk about how we can help.